Gartner just released a few days ago its

2017 Magic Quadrant for Distributed File System and Object Storage and we have some comments about this report as many things have surprised us this year but also last year.

If we need to summarize or qualify in one word the report we should say that it shows a real status quo with no real differences since last year but still some missing vendors and strange positions for some of them not representing how they behave on the market.

Definitions conflicts

The second paragraph of the Market Definition/Description introduces strange terms in conflict with criterias as it is mentioned “object and scale-out file technology” meaning that the scale-out term is applied to file but not object. In the criteria section, a product to be qualified must provide at least 500TB capacity, 1PB namespace with 3 nodes minimum. According to the Gartner definition, this scale-out criteria is good only for file technology. Let’s consider this as an oversight.

We can also argue that you can build a large (it’s a relative notion) scale-up object or file storage product passing the 500TB capacity and 1PB namespace criteria and not be a scale-out. For many use cases and customers, scale-up is good enough.

In the same part, distributed file system is defined with the notion of single parallel file system. This is an other problem introduced by the term parallel here as several companies listed in the quadrant are not aligned with that. A parallel file system relies on the capabilities to split files before touching the back-end data servers. Examples of that are pNFS, Lustre or GPFS, Isilon is not for instance as a file is written via one node and then split in the back and distributed across several nodes. In other words, there is a need for a piece of intelligence embedded in the client to split the data and send to multiple targets.

Criterias evolved

Between 2016 and 2017, Gartner adds two new criterias and modifies one to finally consider 5 criterias:

- A multiple use cases criteria to avoid mono or too niche usages. As a result Panasas exists the quadrant.

- An on-premises criteria and with that companies like Avere Systems, Nasuni or Panzura are out. Is it fair? Not sure as Avere, for instance, is deployed in M&E accounts in front of multiple scalable file storage. At Pixar or Dreamworks, Avere is the front-end layer connected to Isilon, Qumulo…. And everything is stored on-premises.

- IP ownership and open source link with the need to be in the top 10 contributor is the company use free software. Very difficult to assess as several players use open source database among others and don't participate to these projects developments. Does it mean we should exclude them?

Surprises, presences and absences

Qumulo enters the quadrant as Visionnaries and Exablox, now StorageCraft, is back in the Niche Players zone.

We don't understand why file storage companies are not better listed in the report. In fact if the document is about file storage, we should find more references about it.

Does Gartner consider a product or a portfolio around file and object storage, in that case, some companies listed should be in a better position. This is the case for DDN and NetApp for instance. In the opposite if a product is “just” an object storage, it should be impacted. And for object storage, again it’s not clear, do we consider an objet interface or access method or an internal design. Many of these products are not object oriented for design.

Companies with file storage are not listed except this year with Qumulo. This is the case for HPE, Oracle, Microsoft, NEC or Veritas even if they have file or object storage solution, HPE and Oracle don’t have any object storage product but file storage and Veritas recently introduced an object storage but is super strong in file storage. I’m pretty sure the 2018 version will be different with for instance Veritas present in the leaders box.

Where is Microsoft in the picture? Where is Cohesity? Where is Hedvig?

The Big Miss

NEC with HYDRAstor is absent of this picture even if his product activity matches all criterias. Like EMC with Filepool or Hitachi Vantara with Archivas roots, NEC has a CAS history. I invite the reader to check the article

published in July 2016 explaining the CAS and object storage story.

To illustrate some dimensions let me just say that NEC HYDRAstor represents 1,200 users, 2,000 installations, 3EB stored, 70% of revenue from Japan and 30% from EMEA and USA. NEC must be integrated in this Magic Quadrant especially as object storage is essentially dedicated to secondary storage usages what NEC HYDRAstor targets with several use cases.

Other comments

We don't also see how Gartner includes clients’ retention and associated churn especially if a direct competitor swaps some of these players. It will be interested to see if some players replaced others and give them weight.

Object Storage is essentially a tier 2 platform and distributed file systems is cross environments. The three key features for secondary storage are data reduction such compression and reduction, data protection with replication and erasure coding and then cold storage capabilities. All these three elements contribute to a different TCO and ROI and clearly the ranking would have been different, some vendors don't offer any of these three elements which is incredible for a platform that store huge volumes of data over potentially a long period of time. In other words, if a storage platform is just reduced to store data without one, two or all these three elements, its value is very limited.

Extension

And we found also this page on the

Gartner Peer Insights web site. This page also displays the same 15 vendors showing a more representative view of the world presence and activity with a complete different ranking, here are the first seven players for four positions:

- #1 Huawei (5), real surprise to obtain 5

- #2 Cloudian and Qumulo (4.8)

- #3 Red Hat and Caringo (4.7)

- #4 SwiftStack and Exablox (4.6)

and Average = 4.49 and Median = 4.5

We really hope the 2018 version will reflect better products presence and adoption as they’re important misses in the 2017 version. If this quadrant covers seriously DFS, some vendors should appear next year: Avere Systems, Cohesity, Elastifile, HPE, Microsoft, NEC, Rozo Systems, Veritas or WekaIO to list some candidates.

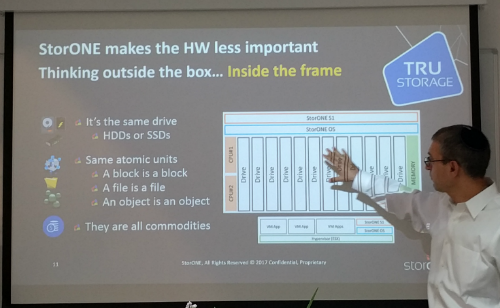

Founded in 2011 by Gal Naor, who has founded Storwize in 2004 and sold it later in 2010 to IBM for $140 million, StorONE has made huge efforts to disrupt the market and the result is quite significant in term of approach and price, delivering the true value of the device users buy everyday. We had the privilege to meet the team and visit StorONE HQ in Tel-Aviv a few day ago with The IT Press Tour crew. And if you follow me, I wrote one of the very first article about StorONE in August 2016 when they made a surprising presence at VMworld 2016 in San Francisco.

Founded in 2011 by Gal Naor, who has founded Storwize in 2004 and sold it later in 2010 to IBM for $140 million, StorONE has made huge efforts to disrupt the market and the result is quite significant in term of approach and price, delivering the true value of the device users buy everyday. We had the privilege to meet the team and visit StorONE HQ in Tel-Aviv a few day ago with The IT Press Tour crew. And if you follow me, I wrote one of the very first article about StorONE in August 2016 when they made a surprising presence at VMworld 2016 in San Francisco.